How can they break free with triple-digit loans?

In a strange twist, a few online loan providers connect their operations with Native American tribes to seriously restrict any appropriate recourse.

The different tribes aren’t really associated with funding the operations, experts state. rather, experts state, outside players are employing a relationship using the tribes to skirt customer security laws and regulations, including restrictions on rates of interest and certification demands.

“It is really quite convoluted on function. They truly are (the loan providers) attempting to conceal whatever they’re doing,” stated Jay Speer, executive director for the Virginia Poverty Law Center, a nonprofit advocacy team that sued Think Finance over alleged illegal financing.

Some headway ended up being made come early july. A Virginia settlement included a vow that three lending that is online with tribal ties would cancel debts for customers and get back $16.9 million to large number of borrowers. The settlement apparently impacts 40,000 borrowers in Virginia alone. No wrongdoing had been admitted.

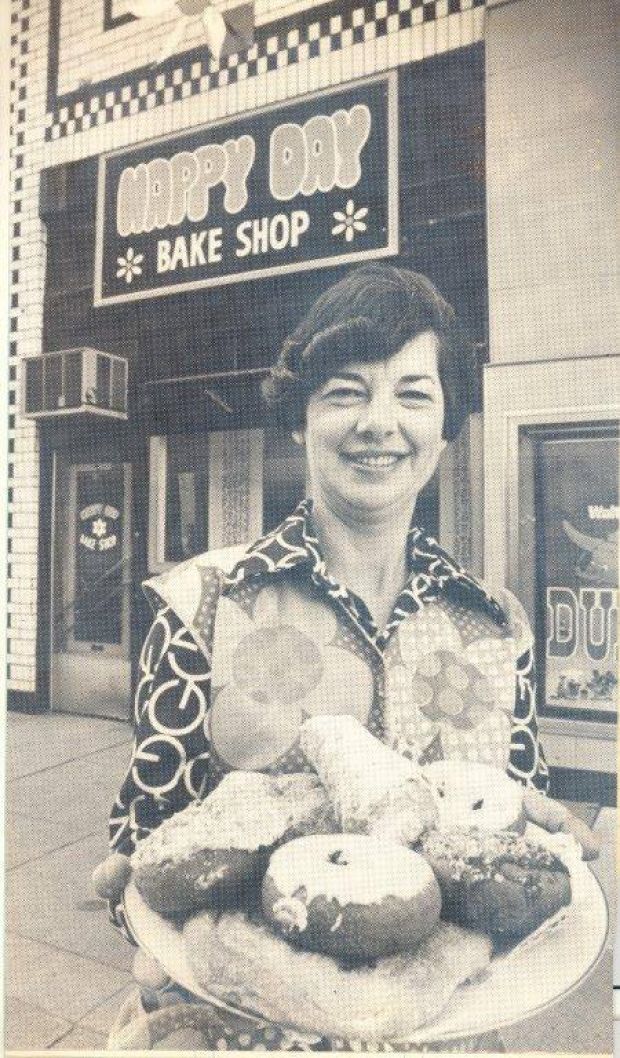

Plain Green — a lending that is tribal, wholly owned by the Chippewa Cree Tribe associated with Rocky Boy’s Indian Reservation in Montana — provides online loans but Д±ndividuals are charged triple-digit interest levels. (Picture: Susan Tompor, Detroit Complimentary Press)

Beneath the Virginia settlement, three businesses underneath the Think Finance umbrella — Plain Green LLC, Great Plains Lending and MobiLoans LLC — consented to repay borrowers the essential difference between just what the firms built-up additionally the limitation set by states on rates than are charged. Virginia features a 12% limit set by its usury legislation on prices with exceptions for many lenders, such as licensed payday loan providers or those making vehicle name loans who are able to charge greater prices.

In June, Texas-based Think Finance, which filed for bankruptcy in October 2017, decided to cancel and pay off almost $40 million in loans outstanding and originated by Plain Green.

The customer Financial Protection Bureau filed suit in November 2017 against Think Finance for the part in deceiving customers into repaying loans which were perhaps not lawfully owed. Think Finance had been already accused in numerous federal lawsuits to be a lender that is predatory its bankruptcy filing. Think Finance had accused a hedge investment, Victory Park Capital Advisors, of cutting down its usage of money and precipitating bankruptcy filing.

It is possible Swiger could get some relief later on if a course action status Baskin is seeking is authorized, since would other customers whom borrowed at super-high prices with one of these lenders that are online.

“I’m not sure where this will be planning to wind up,” Baskin stated

The fee is crazy however, if you are in an urgent situation, you’ll talk your self into convinced that possibly it’s going to all exercise.

A number of these operators that are online how exactly  to promote the loans

to promote the loans

Consumer watchdogs and lawyers trying to simply simply simply take legal action keep that the tribal affiliation is however a scheme. Some get as far as to phone it an enterprise that is”rent-a-tribe that is set up to declare sovereignty and evade federal banking and consumer finance regulations, in addition to state usury regulations.

Nobody, needless to say, will probably a storefront in Montana or any place else to have one of these simple loans.

“they are all done on the internet,” stated Andrew Pizor, staff lawyer for the nationwide customer Law Center.

Karl Swiger could not think exactly just how their 20-something child somehow lent $1,200 online and got stuck with a annual interest of approximately 350%.

“When we heard I thought you can get better rates from the Mafia,” said Swiger, who runs a landscaping business about it. He just learned about the mortgage once their child needed help making the payments.

Yes, we are dealing with that loan price that is not 10%, perhaps maybe not 20% but a lot more than 300%.